Buyers and billing details

To optimize 3-D Secure it is highly recommended to provide a buyer with billing details attached to Embed. A buyer can be set up via thePOST /buyers

API. The buyer can then be attached to Embed by using the buyerId or

buyerExternalIdentifier property. The buyer’s name, email address, and billing

address are used to help reduce buyers being asked to complete a 3-D Secure

challenge.

The instance ID is the unique identifier for the deployment of the system and is included in every API call.

Together with the environment (sandbox or production) it is used to connect to the right APIs, as well as dashboard.

Features

For every transaction, we will handle the following steps.- Detect if any Flow rule explicitly requires or skips 3-D Secure

- Detect if the selected payment service for this transaction has 3-D Secure enabled

- Detect if the card used in the transaction is enrolled for 3-D Secure

- Handle the seamless frictionless 3-D Secure flow including the device finger printing

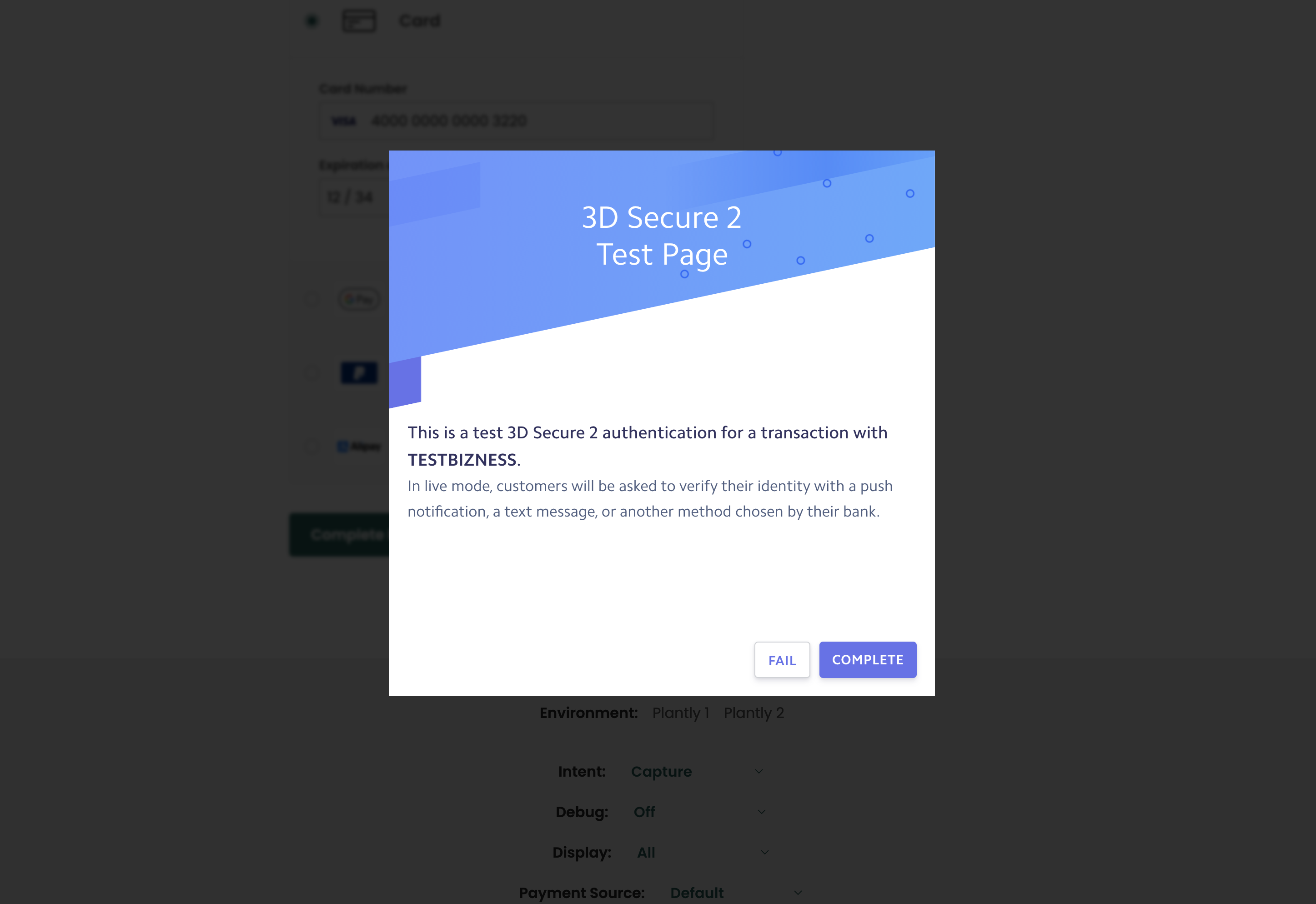

- Handle the 3-D Secure challenge flow, where a buyer is directed in-page to their bank to approve the transaction